Insurance CRM, Evolved

Introduction to HubSpot for Insurance

Over one-third of insurance organizations still rely on manual data transfers between disconnected systems and only 3% extend their AMS into CRM, marketing, or analytics.

HubSpot fills that gap. It acts as the connective tissue for fragmented tech stacks, giving insurance agencies, brokerages, and carriers a centralized, secure platform to manage sales, marketing, and policy operations. From onboarding and quoting to renewals and claims, HubSpot helps insurance teams replace manual processes with automation, improve visibility, and scale without sacrificing compliance.

Whether you’re managing renewals, syncing producers, or tracking opportunities, the Applied Epic ↔ HubSpot integration keeps your AMS data accurate, actionable, and connected.

What you can do:

- Sync Clients ↔ Contacts

- Map Opportunities to Deals

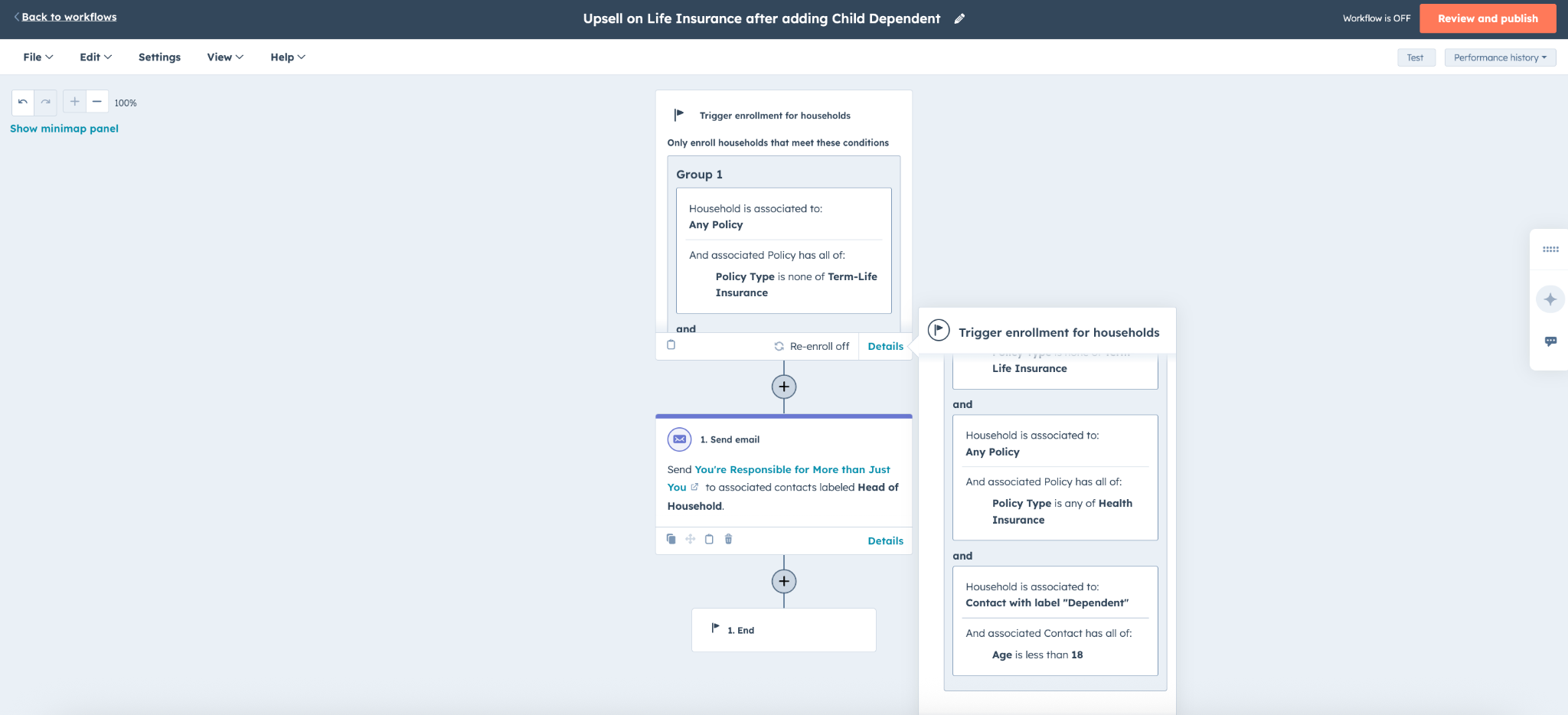

- Create Workflows for Renewals & Claims

- Trigger Marketing Campaigns Based on Policy Events

- Centralize Reporting Across System

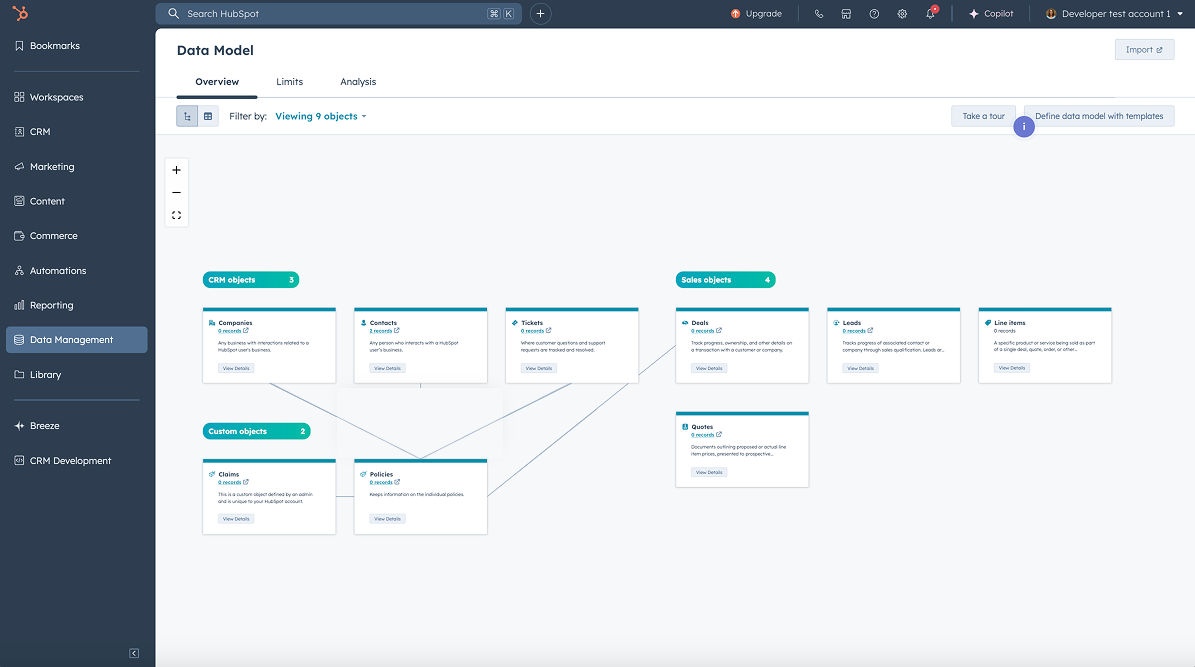

HubSpot’s flexibility allows insurance organizations to tailor CRM objects around their unique workflows and policy structures.

Common Data Structures:

- Contacts → Policyholders, claimants, producers

- Companies → Insurance carriers, partners, brokerages

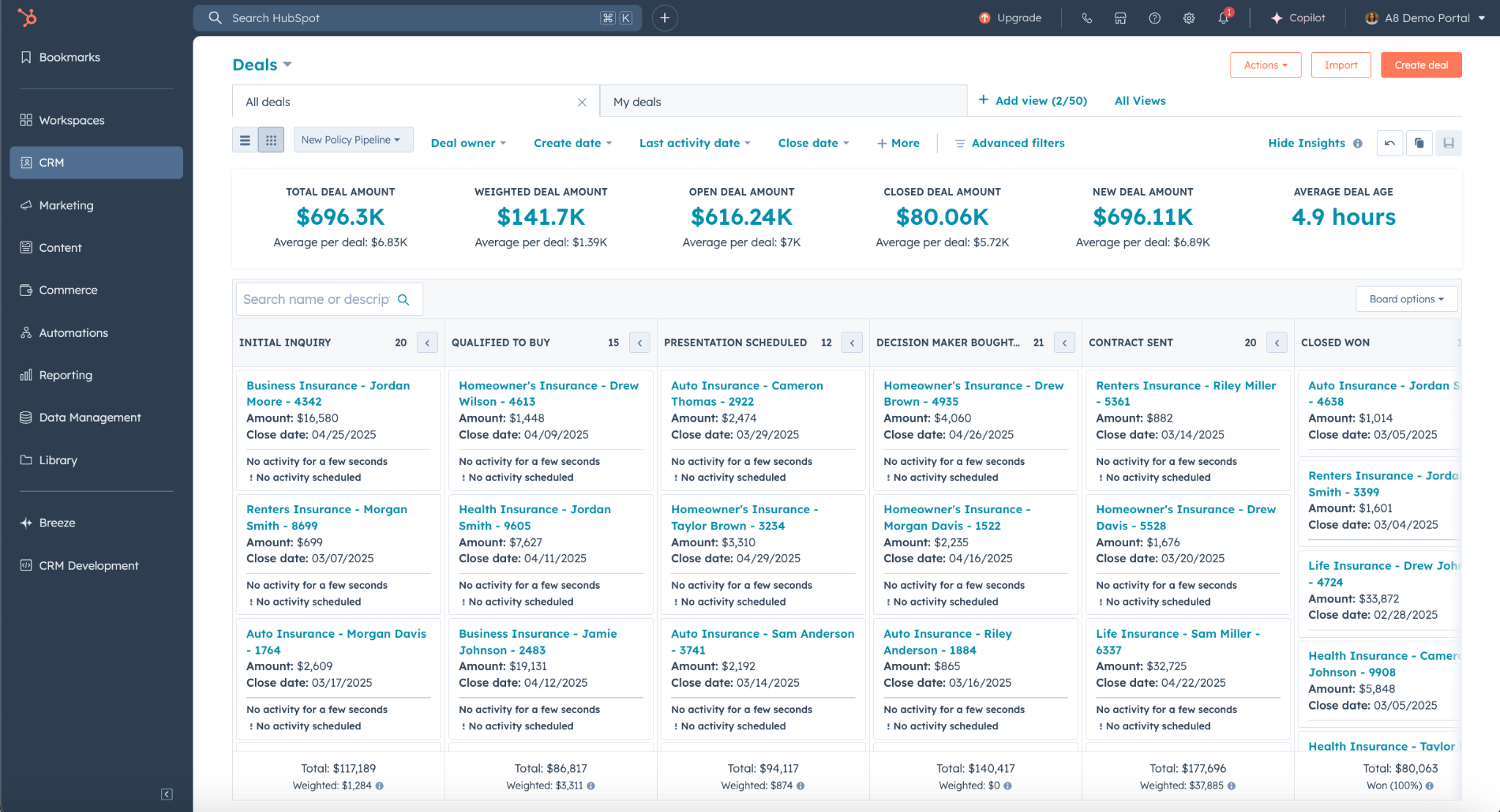

- Deals → Policy quotes, renewals, cross-sells

- Custom Objects → Policies, claims, coverages, commissions

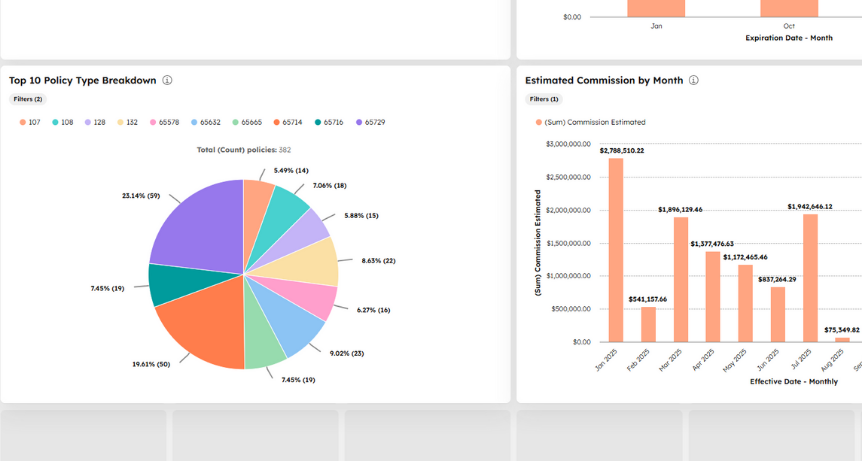

Avoid missed renewals, manual follow-ups, and spreadsheet sprawl.

HubSpot enables:

- Automated reminders for clients and producers

- Smart workflows that flag expiring policies and suggest cross-sells

- Renewal dashboards by rep, policy type, or region

- Pre-built email templates for faster, more effective outreach

With centralized tracking, agencies boost retention, reduce churn, and prevent coverage lapses.

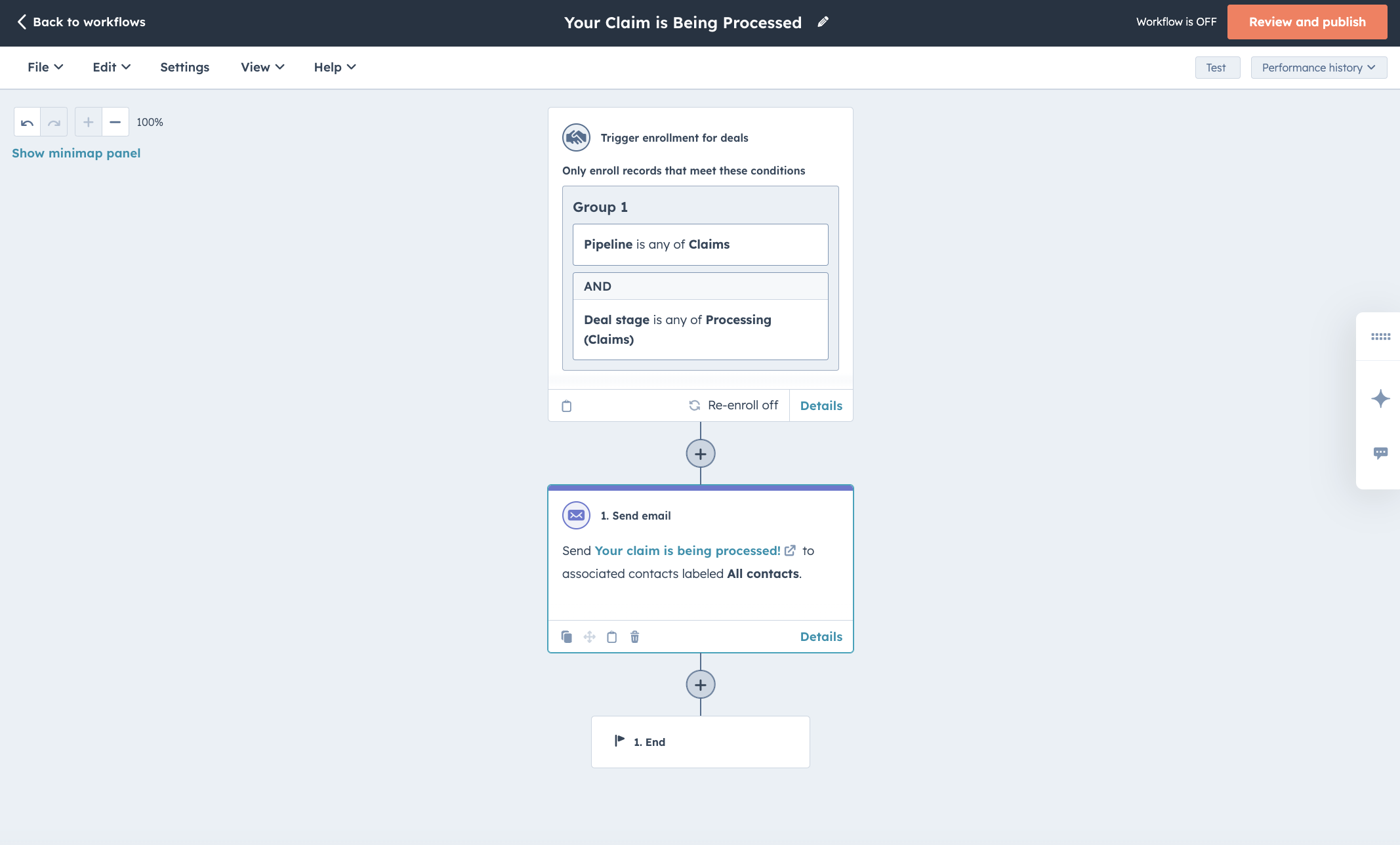

Claims are often slowed by fragmented systems and manual processes.

HubSpot streamlines the entire lifecycle:

- Deal pipelines track claims from FNOL to resolution

- Automated data capture speeds up triage

- Email and ticket workflows keep clients informed

- Dashboards monitor timelines and open claims

Centralized automation improves efficiency and boosts client satisfaction.

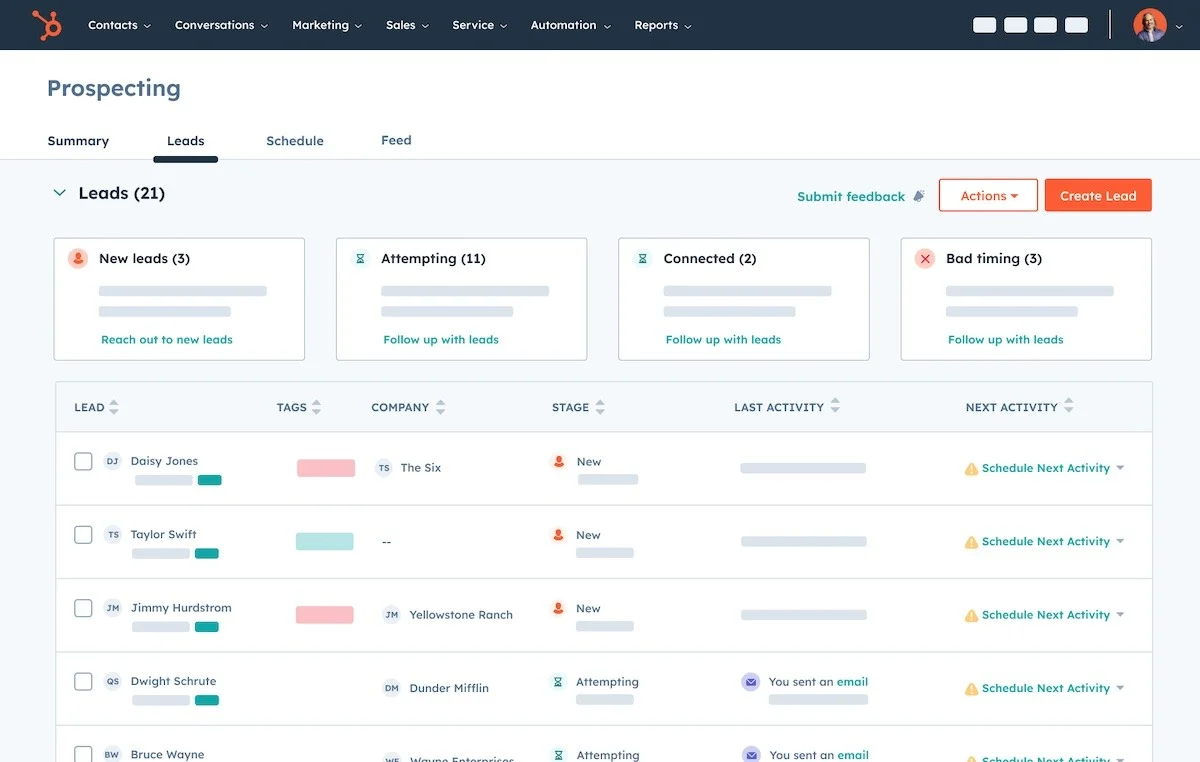

HubSpot helps agencies move beyond cold calls with smarter lead management:

- Capture high-intent leads via forms, landing pages, and referrals

- Score and prioritize prospects by policy size and urgency

- Nurture by product line with segmented workflows

- Guide reps with dashboards showing next best actions

Every opportunity gets fast follow-up and your top reps stay focused on the best leads.

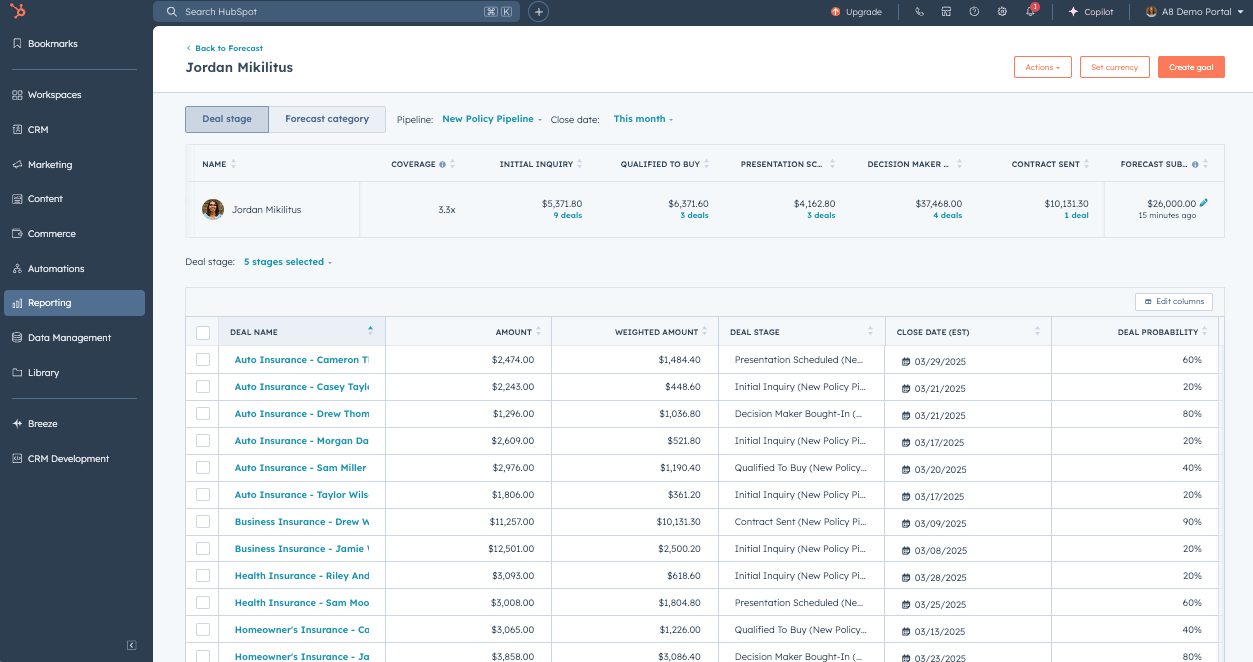

Insurance teams juggle clients, policies, and deadlines—HubSpot simplifies it:

- Dashboards centralize clients, tasks, and renewals

- Task automation handles reminders and follow-ups

- Personalized workspaces for each producer or team

- Pipeline visibility across Commercial, Personal, and Benefits lines

Streamlined workflows improve follow-through and reduce burnout.

For growing agencies, client engagement must scale. HubSpot’s portal capabilities allow clients to:

- View active policies, coverage types, and renewal dates

- Submit tickets, update information, or file claims

- Message your team directly and securely

- Track resolution status and get notified automatically

This gives clients more control, while giving your team more time.

.png)

Key Outcomes:

- Integrated HubSpot with Applied Epic

- Unified sales, marketing, and operations data

- Segmented by product line, producer, and region

- Trained internal teams and 1099 brokers

“Acrisure’s success shows how HubSpot can scale in legacy-heavy insurance environments, enabling simpler selling, stronger relationships, and real-time visibility.”